Elevate Your Proficiency with Bagley Risk Management

Elevate Your Proficiency with Bagley Risk Management

Blog Article

How Animals Danger Protection (LRP) Insurance Policy Can Secure Your Animals Financial Investment

In the world of livestock investments, mitigating risks is critical to ensuring financial stability and growth. Animals Danger Protection (LRP) insurance stands as a trustworthy guard versus the uncertain nature of the market, offering a critical approach to protecting your possessions. By diving into the complexities of LRP insurance policy and its diverse benefits, animals manufacturers can fortify their investments with a layer of protection that goes beyond market fluctuations. As we discover the world of LRP insurance, its duty in safeguarding animals financial investments comes to be increasingly evident, assuring a course towards sustainable monetary durability in an unpredictable sector.

Recognizing Animals Threat Security (LRP) Insurance

Understanding Animals Danger Protection (LRP) Insurance policy is necessary for livestock producers looking to mitigate economic dangers related to cost fluctuations. LRP is a government subsidized insurance coverage product created to secure producers against a decrease in market value. By supplying protection for market price decreases, LRP aids manufacturers secure a flooring rate for their livestock, guaranteeing a minimal level of earnings despite market fluctuations.

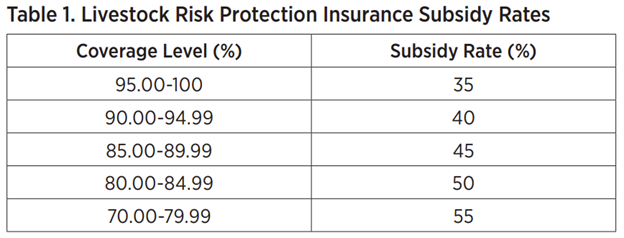

One trick aspect of LRP is its adaptability, allowing producers to tailor protection levels and plan sizes to fit their particular demands. Manufacturers can pick the number of head, weight array, protection price, and insurance coverage period that straighten with their production objectives and risk tolerance. Recognizing these customizable choices is crucial for manufacturers to effectively manage their rate risk direct exposure.

In Addition, LRP is readily available for various livestock kinds, consisting of cattle, swine, and lamb, making it a flexible threat management tool for livestock manufacturers throughout various sectors. Bagley Risk Management. By familiarizing themselves with the ins and outs of LRP, manufacturers can make informed decisions to secure their financial investments and guarantee monetary security in the face of market uncertainties

Benefits of LRP Insurance Policy for Animals Producers

Livestock manufacturers leveraging Animals Risk Defense (LRP) Insurance acquire a calculated benefit in shielding their financial investments from rate volatility and safeguarding a stable financial footing in the middle of market unpredictabilities. By setting a flooring on the cost of their livestock, manufacturers can reduce the threat of considerable financial losses in the occasion of market slumps.

Additionally, LRP Insurance provides producers with peace of mind. In general, the advantages of LRP Insurance for livestock producers are substantial, using a useful tool for handling danger and guaranteeing monetary safety in an unforeseeable market setting.

Just How LRP Insurance Policy Mitigates Market Threats

Minimizing market risks, Livestock Threat Security (LRP) Insurance coverage provides livestock manufacturers with a reputable guard versus price volatility and monetary unpredictabilities. By using protection versus unforeseen price decreases, LRP Insurance coverage assists manufacturers secure their financial investments and keep financial security in the face of market changes. This kind of insurance policy permits animals producers to secure in a cost for their animals at the start of the plan duration, guaranteeing a minimal price degree despite market adjustments.

Steps to Protect Your Livestock Investment With LRP

In the realm of agricultural danger administration, carrying out Animals Threat Defense (LRP) Insurance policy entails a critical procedure to guard financial investments versus market changes and uncertainties. To protect your livestock investment effectively with LRP, the very first step is to analyze the details risks your procedure deals with, such as rate volatility or unanticipated weather events. Comprehending these dangers allows you to determine the coverage degree needed to safeguard your investment properly. Next, it is critical to study and choose a reputable insurance policy carrier that uses LRP policies customized to your livestock and company demands. When you have picked a supplier, very carefully evaluate the plan terms, problems, and coverage restrictions to guarantee they align with your threat administration goals. In addition, consistently keeping an eye on market trends and readjusting your insurance coverage as needed can aid enhance your protection versus prospective losses. By complying with these steps vigilantly, you can enhance the protection of your animals financial investment and navigate market unpredictabilities with confidence.

Long-Term Financial Security With LRP Insurance Policy

Making sure withstanding financial stability via the application of Livestock Risk Protection (LRP) Insurance coverage is a sensible long-lasting method for agricultural producers. By incorporating LRP Insurance right into their threat monitoring strategies, farmers can secure their livestock investments versus unpredicted market fluctuations and adverse occasions that can threaten their economic wellness gradually.

One key benefit of LRP Insurance for lasting economic protection is the comfort it provides. With a trusted insurance plan in position, farmers can reduce the financial threats related to unstable market conditions and unexpected losses due to factors such as condition break outs or natural calamities - Bagley Risk Management. This stability allows look at here now manufacturers to concentrate on the everyday procedures of their livestock service without continuous concern regarding potential economic problems

Moreover, LRP Insurance policy gives an organized method to taking care of danger over the long term. By establishing details insurance coverage levels and choosing suitable endorsement periods, farmers can customize their insurance plans to straighten with their economic objectives and run the risk of tolerance, guaranteeing a secure and Home Page lasting future for their livestock procedures. Finally, investing in LRP Insurance policy is a positive strategy for farming producers to attain long lasting financial protection and secure their livelihoods.

Final Thought

Finally, Livestock Risk Security (LRP) Insurance coverage is a beneficial device for livestock producers to reduce market dangers and safeguard their financial investments. By recognizing the benefits of LRP insurance policy and taking actions to apply it, manufacturers can achieve long-term monetary safety for their operations. LRP insurance policy provides a security internet versus cost changes and makes sure a degree of stability in an unforeseeable market atmosphere. It is a smart option for protecting livestock investments.

Report this page